Digital offices have grown increasingly prevalent as a result of the exponential growth of contemporary technology. Additionally, you will need to append a signature to certain documents at some point. You will require an alternative method to add an electronic signature to a document or similar paper. For such papers, we often utilize a digitized one. However, it is common for the digitized signature to have an unsightly background requiring to be removed. In this light, the question of how to digitally sign papers on a computer has emerged as an issue. Because of this, an electronic signature background cleaner is now essential. If you want your signature’s background removed, you’re in luck as there are plenty of options. In this article, we will discuss the top and most reliable background remover for e signature along with their features.

Table of Contents

List of background remover for e signature

FocoClipping

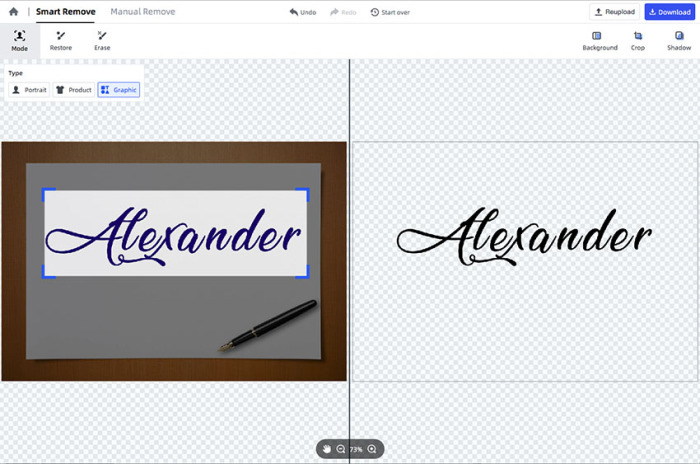

A common web application for eliminating the backdrop from a signature is Fococlipping. Let’s take a quick look at the features that make FocoClipping ideal for online signature image backdrop removal. This background remover for e signature has an intuitive and easy-to-navigate interface. Having said that, there are a plethora of capabilities available beneath the surface of its basic UI. Because of this, it is also an ideal tool for editing online signature photographs by removing the backdrop. In addition, there are further editing options available using the Fococlipping application. The following are a few of the functions offered by this web-based signature’s background backup cleaner.

Key Highlights

- With only one click, our smart AI can automatically remove the backdrop from your signature picture online.

- Mastery of detail-oriented image processing for complicated pictures.

- Use blue for the foreground and red for the backdrop. Get the edge details just right.

- All of the difficult details are taken care of by the app. For fine-tuning, use the original color.

- Portrait and object-specific filters to bring forth their best features.

Remove. bg

Remove. bg is yet another well-known program that can be used to erase the backdrop of a signature online for free. The Remove. bg utility is a very basic application that does not include any further capabilities. Nevertheless, on the other side, Remove. bg is powered by a vast artificial intelligence engine that is quite sophisticated. By doing so, it eliminates the backdrop of the signature that is shown online and makes a clear distinction between the sign and the surrounding portions.

Key Highlights

- The algorithms are designed to manage even potentially difficult picture aspects utilizing the newest artificial intelligence (AI) tools.

- Quickly and easily erase backgrounds using the backdrop remover.

- The desktop program makes it easy to quickly and easily drag and drop an infinite number of files at once.

- Effortlessly personalize your work by defining it once and applying it to all files. You may choose the backdrop color, size (small or big), and transparency of all your files with only a few clicks.

IMAGE.CO

The electronic signature background remover is known as Image. co is free to use and may be accessed by anybody. All you have to do is choose a signature. After that, choose the color of the backdrop that you want to get rid of. Adjusting the blur setting at your convenience allows you to make more exact choices. Image. co is a significant step ahead of its rivals compared to other background removers for e signature that are available on the market. It made the procedure easier to carry out in general, to put it another way.

Key Highlights

- Quickly and easily erase the backgrounds of several images using this background removal software.

- For the quickest and most effective background removal, use the image. co application.

- It tackles even the most challenging areas with ease and produces professional-grade results every time.

- The backdrop remover is now available for download and works with several operating systems like Windows, Mac, and Linux.

FlexClip

When it comes to eliminating the backdrop from the sign of a document that is found online, FlexClip is among the most effective and user-friendly online solutions available. When it comes to the signature, are you having trouble doing professional background editing? FlexClip could be the ideal choice if you cannot spare enough time to acquire insights essential to removing the background from the e-signature. It has effective tools that can successfully remove backgrounds from signatures.

Key Highlights

- With only one click, you may erase the backdrop of your signature using an artificial intelligence background remover for your e-signature.

- You may upload photographs of your signature or other files from your phone and additional third-party platforms such as Dropbox, One Drive, G-Drive, and others.

- The application conducts a comprehensive examination of the distinctive traits of the digital signature to guarantee perfection.

- The removal of the backdrop from the signature is quick.

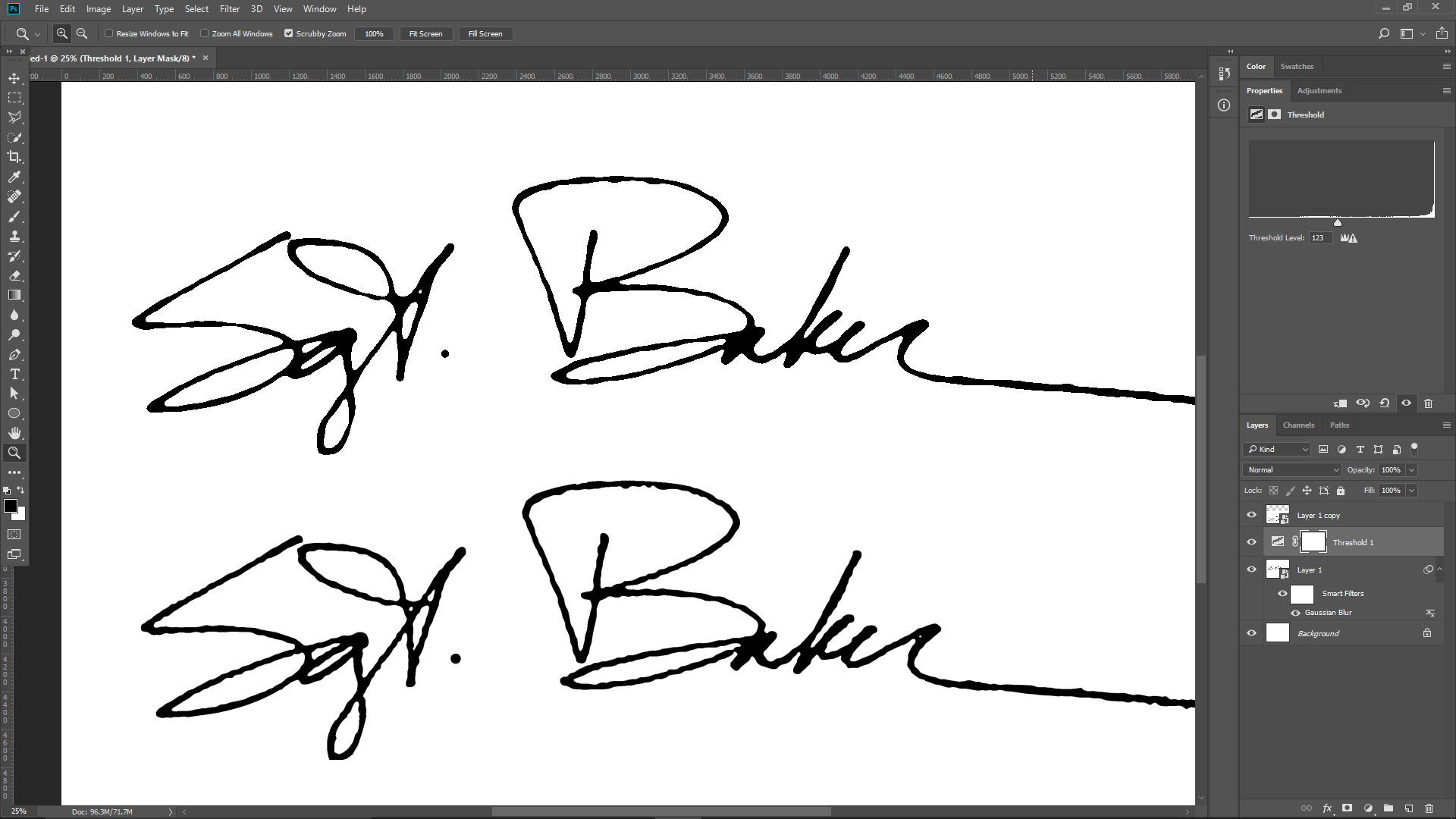

Adobe Photoshop

Photoshop from Adobe gives you the ability to tap into the creative potential of Adobe. It allows you to edit your files without the inconvenience of spending time installing the program on your computer, and it offers superb editing tools. Among the many programs used for modifying images, Adobe Photoshop is among the most widely used. It is possible to alter the blur setting to suit your requirements. This digital signature background removal program uses artificial intelligence technologies to render a transparent background. In addition, Adobe Photoshop is not only a transparent signature creator; it is far more than that. It provides you with various tools that might assist you in erasing the backdrop of your signing document.

Key Highlights

- The result is a higher level of precision compared to conventional picture-altering tools.

- The backdrop of almost any electronic signature may be removed from it in a few seconds by using this program.

- You must turn on the internet connection so that the application can perform the tasks.

- The software ensures that the signature’s quality remains intact.

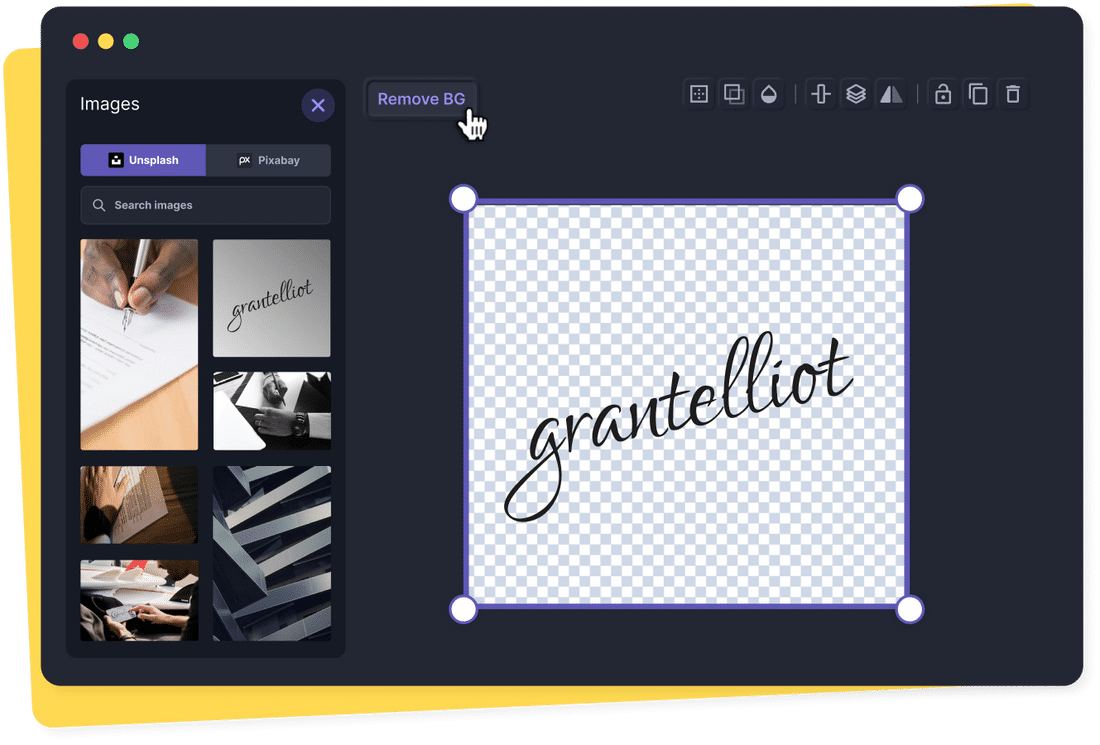

Pixelied

If you want to change the quality of your document or alter your unique signature on the internet, Pixelied is the app for you. Make your signature visible to enable its use in many documents. Pixelied makes making clear signatures a breeze. It is another well-liked choice among those looking for an accessible online sign background eliminator. A robust AI engine powers this web-based background remover. As a result, one might be able to differentiate the e-signature from the background with ease. There is no size restriction when using the program to upload your signature’s picture. The most advanced automatic signature editing is available to you.

Key Highlights

- Background removal becomes simple and uncomplicated by advanced artificial intelligence.

- Additional personalization choices regarding e signature background removal are available to the user.

- All the different kinds of signature altering are accessible via the user-friendly interface.

Final words

A signature is a common way to confirm the legitimacy of an e-mail or file, and it is a critical aspect of both formal and informal correspondence. The removal of backgrounds from digital signatures is becoming an urgent need. The most user-friendly e-signature background removal applications are in this article. In addition to their other picture editing tools, these background removal alternatives are top-notch tool that gets the job done quickly without sacrificing quality. Now that you’ve read this post, you should have all of the answers you need about removing the background of the signature.

FAQs

Q1. Are these tools compatible with mobile devices?

Sure thing! With the abundance of online signature backdrop removal solutions available on mobile web pages, it’s simple, easy, and available from any place at any moment.

Q2. Does this software save or share personal signatures?

No, trustworthy software will never keep or distribute a copy of your electronic signature. The application’s top goals include protecting user confidentiality and information.

Q3. How does the background remover for e-signature make the signature see-through?

Improving electronic paperwork with an electronic signature that has a translucent backdrop is a breeze with the help of picture software that edits.

Q4. Does such use involve any legal dispute?

There are no risks or legal repercussions associated with using background remover for e signature for either personal or business use. It is prudent to verify the applicable legislation and rules in your jurisdiction carefully. Using the tool ethically is essential at all times.

Arpita Das Gupta hails from the City of Taj Mahal, Agra; decided to become a full-time writer after quitting her job at a multinational organisation to pursue her dream. For the last six years, she has written on many aspects of modern life. Has a passion for writing about wellness, nutrition, culinary cultures, and everything in between. Also attended Integral University in Lucknow, where she earned a Bachelor of Technology degree in Electronics and Communications. Reading, traveling, trying out new recipes, and spending time with her kid are some of the favorite things to do.