There is one feature “live caption”. It’s a user-friendly feature that is found in almost every Android device that converts speech into real-time. You don’t require it every time, there must be times when you want to turn off this feature. Want to know how to turn off live captions on Android? Let’s explore it through a direct and easy process to switch off the live Caption option on your Android device.

Table of Contents

Understand Live Caption

Let’s start by giving a brief definition of live captioning. The majority of contemporary Android devices have this feature that converts spoken words into written or printed text. There are situations when you are watching a video in a noisy place or need help understanding what is being said. In such situations, this feature is very beneficial.

However, there might be some typical cases where you have turned it on accidentally or just don’t require it. The best thing about this feature is that it is easy to turn off quickly. It is one of the most crucial and useful features of Android. In simple words live captions transform the sound of video into subtitles. These subtitles are curated by Google’s machine learning. This way we can also watch the videos quietly without making any disturbance but it’s not necessary to keep it on. It varies from situation to situation whether you want to turn it off or on. There can be a situation where you would only prefer to turn this “live caption” feature off.

How to Disable the Live Caption?

Let’s move one step ahead and learn the step-by-step procedure to know how to turn off live captions on Android:

Step 1: Initiate it by going to the “settings” option of your Android phone.

Step 2: For most latest Android phones, there is a search bar available at the top of the settings screen. Click on that.

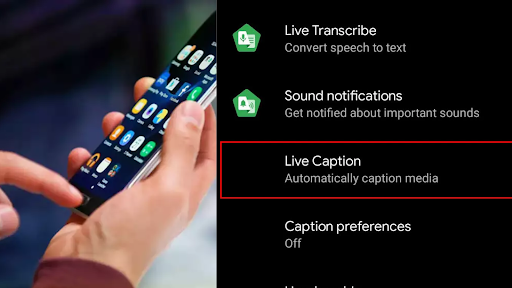

Step 3: Now that you have come to the search bar, type the words “live caption” in the search bar. Follow the steps carefully as assisted here.

Step 4: After Clicking on the “live caption”, you’ll see that the live caption setting comes on the screen.

Step 5: At last, you can now switch it off directly from the screen.

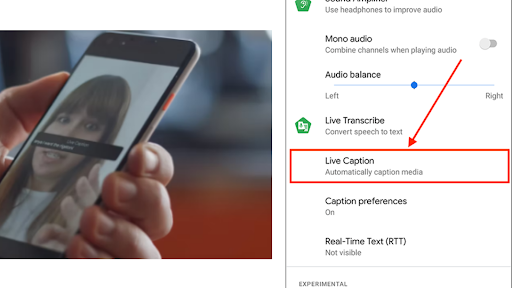

Substitute Way to turn off the Live Caption on Android

Let’s learn about the alternative method to turn off live captions on Android:

Step 1: Go to the “Settings” option.

Step 2: Scroll down till you get the “accessibility” option on the screen. Once you see the “accessibility” option, click on it.

Step 3: After that Click on the “hearing enhancements” option.

Step 4: Now there will appear a “live caption” option.

Step 5: Now just like the last procedure click on it and turn it off.

This way the live captions on your Android will be turned off without facing any kind of hurdles during the procedure.

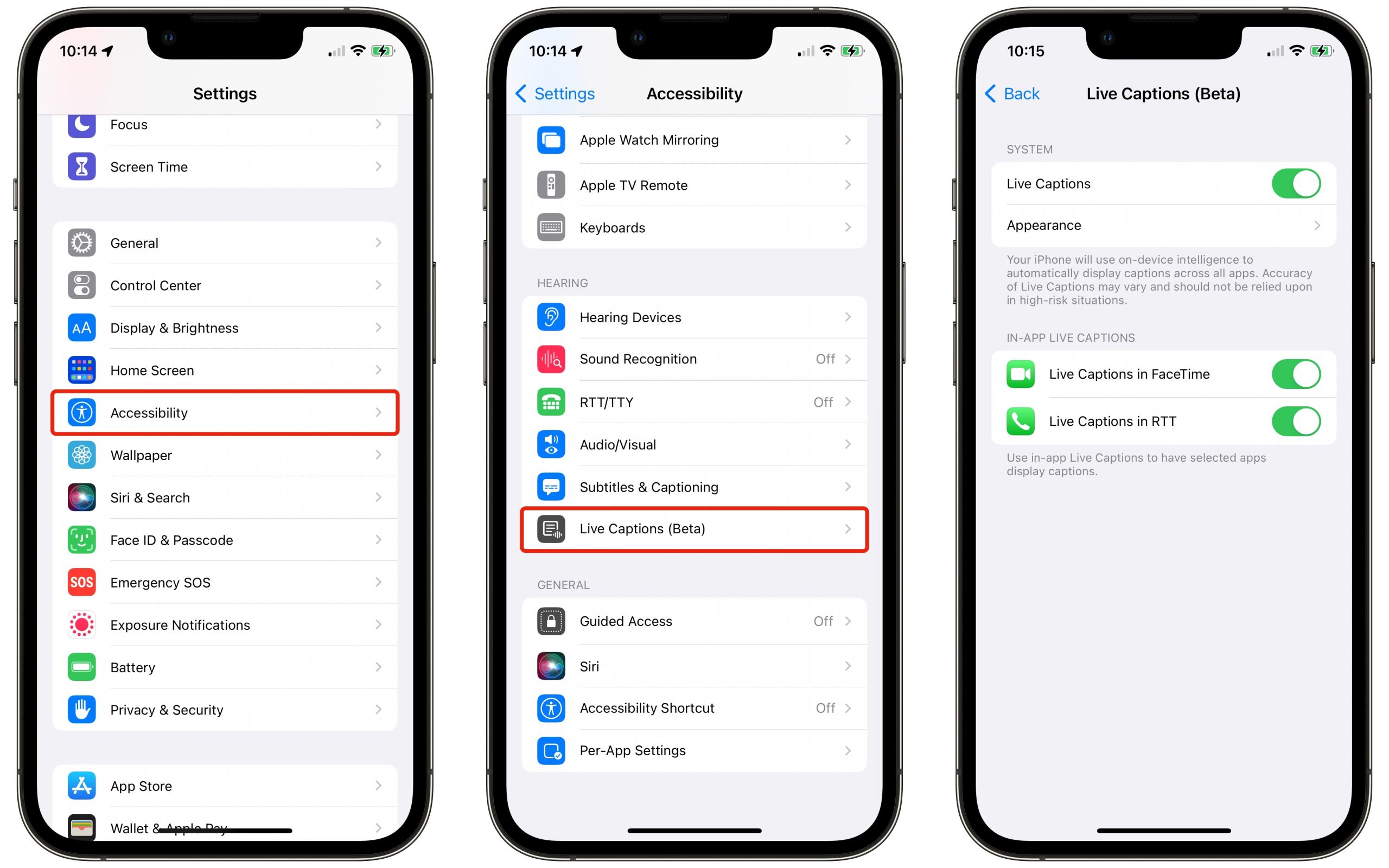

How to turn off the live captions on iphone?

To disable the live captions on your iPhone, follow the steps:

1- Go to the settings of your phone.

2- Click on Accessibility.

3- Click on “Live Captions”.

4- You can also click three times on the home and side button to toggle the live caption on or off.

Conclusion

So here it was the easy and handy procedure to know how to turn off live captions on Android. Remember that live captions can be beneficial when you needed. We hope we were able to explain to you about the live captions on Android. Every feature in your smartphone is there to simplify your experience. Connect with us and keep exploring such more informative articles. Stay tuned to read more about Android features.

Anshika Bhandari is a content writer with 2 years of experience in content writing. She has written content for Digital Marketing Agencies, Modeling Agencies, and Household services. Currently, she is associated with an agency where she writes for the Entertainment industry, Technical industry, Education services, etc.