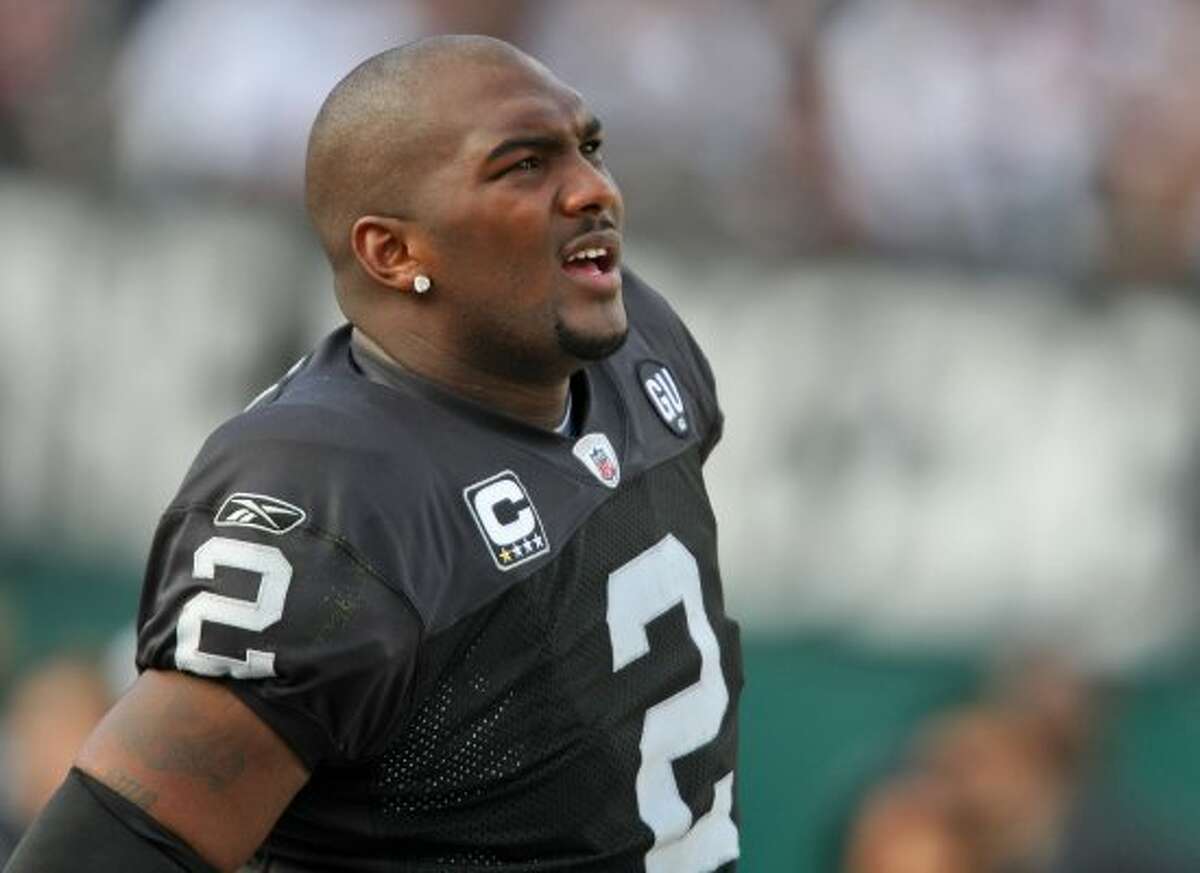

Jamarcus Russell is a former American football player who was one of the NFL’s most successful and talented quarterbacks. He was known for his arm strength and accuracy, and he made waves when he was drafted first overall by the Oakland Raiders in 2007. Over the course of his career, he has earned millions of dollars in salary and endorsements. In this blog, we will explore Jamarcus Russell net worth and career highlights to understand his success and financial outlook better. We will discuss how he made his money, his current net worth, and what the future may hold for him.

Table of Contents

What is JaMarcus Russell Net Worth?

As of March 2023, Jamarcus Russell net worth is estimated to be around $4 million. Despite signing a lucrative contract worth $39 million during his three years in the NFL, he failed to live up to expectations, and his contract was essentially voided in 2009. His main source of income was his professional football career. While his net worth could have been higher if circumstances turned out differently, he still made significant money from his short NFL career.

Career Earnings

JaMarcus Russell is a former NFL quarterback who played for the Oakland Raiders. According to various sources, including Spotrac and Over The Cap, Russell earned $39,365,000 in his NFL career.

He signed a six-year, $68 million contract with the Raiders in 2007, including a $32 million guarantee, making him one of the highest-paid players in the league at the time. However, his career was short-lived due to his lack of success on the field, and the Raiders released him in 2010. Despite his large contract, his career earnings were not enough to sustain his lifestyle, as he faced financial troubles after leaving the NFL.

Real estate

According to various sources, former NFL quarterback JaMarcus Russell purchased a mansion in Oakland, California, in 2007. The property reportedly has over 27,000 square feet of living space, a fireplace, six bedrooms, a four-car garage, and views of the bay. Jamarcus Russell net worth is $4 million. However, in 2011 it was reported that the house was sold after the bank took possession of it.

More to Know About JaMarcus Russell

Early life

JaMarcus Trenell Russell was born on August 9, 1985, in Mobile. Bobby Lloyd was his father, and he worked as a machine operator. Zina L. Russell-Anderson was his mother, and she worked as a secretary at a law firm.

Bobby Parrish was the coach of JaMarcus during his time at Lillie B. Williamson High School in Alabama. Throughout his four-year tenure at the school, JaMarcus played as the starting quarterback in every game and never failed to show up for any matches. In his first year, he helped Williamson advance to the state championship game by completing 180 out of 324 passes, accumulating 2,683 yards, and throwing 20 touchdowns.

Russell’s success on the field led to him receiving a scholarship offer to play collegiate football from Louisiana State University (LSU). At LSU, he had a successful college football career before declaring for the 2007 NFL draft. There he was selected first overall by the Oakland Raiders.

In 2009, Russell signed a six-year, $68 million contract with the Oakland Raiders, with $32 million guaranteed, making him one of the highest-paid quarterbacks in the NFL at the time. Despite high expectations, his professional career did not match his early high school and college success. He struggled to perform well on the field, ultimately leading to his release from the Raiders in 2010.

Career

JaMarcus Russell was a former NFL quarterback who played for the Oakland Raiders from 2007 to 2009. He was born on August 9, 1985, in Mobile, Alabama. Russell played high school football at Lillie B. Williamson High School in Mobile, where he broke several quarterback records in the state. He eventually became the all-time passing leader in Alabama HS history, throwing for 10,744 yards.

In the 2007 NFL Draft, the Oakland Raiders picked Russell first overall. He signed a six-year, $61 million deal, making him the highest-paid player in NFL history at the time. However, Russell’s NFL career was brief and mostly unsuccessful. He played in 31 games, completing 354 of 680 passes for 4,083 yards and 18 touchdowns. Russell struggled with weight and dedication issues and was released by the Raiders in 2010.

Russell had a 9-22 record in his career. He was criticized for holding out during his rookie season, which caused him to miss important practice time. Jamarcus struggled to adjust to the speed and intensity of the NFL game when he finally joined the team. Despite his potential, Russell’s career never met expectations, and he was out of the NFL by age 25.

Legal Issues

In 2010, he failed a drug test due to his use of the drink “lean”. A mixture of codeine and soda, which he used to cope with injuries while at LSU. In 2022, he was charged with possessing codeine syrup after being arrested at his home in Mobile, Alabama.

Russell has also faced criticism for his lack of passion for football, which some belief contributed to his lack of success in the NFL. Despite his rocky relationship with the Oakland Raiders, the team recently made their final payment to Russell to close the chapter on their three-year relationship.

Awards

JaMarcus Russell was highly successful during his college career at LSU, where he was named MVP of the 2007 Sugar Bowl. Earned multiple awards such as the Manning Award, the Allstate Sugar Bowl MVP, First-Team All-SEC (AP, SEC Coaches). He was named LSU’s Charles McClendon Most Valuable Player for the 2006 season. However, his professional career in the NFL did not meet expectations, and the Oakland Raiders released him in 2010.

Despite his lack of success in the NFL, JaMarcus Russell’s accomplishments during college are noteworthy and earned him several awards and accolades.

FAQ:

1. Who is JaMarcus Russell?

A. JaMarcus Russell is a famous American football quarterback.

2. How Old Is JaMarcus Russell?

A. He is 38 years old.

3. What is JaMarcus Russell’s net worth?

A. JaMarcus Russell’s estimated net worth is $5 million.

4. When does JaMarcus Russell’s birthday come?

A. His birthday is on 9 August.

5. How tall is JaMarcus Russell?

A. He is 6 ft and 3 inches tall.

Final words

However, his professional career was plagued with controversy, poor performance, and off-field issues. Ultimately leading to his release from the team in 2010.

Despite his struggles in the NFL, Russell had a successful high school and college career, setting records at Williamson High School in Mobile, Alabama, and Louisiana State University. While Russell’s story is a cautionary tale about the risks of investing in highly touted prospects. It also highlights the importance of character evaluation and fit within a team’s system.