Microblading is one of the most popular cosmetology procedures trending currently. If you are wondering about how long does microblading last, you probably know what it is. However, some of our readers might be new to this concept. Hence, considering everyone, let us first describe the concept of microblading. As we move further in this blog, we will discuss all other aspects related to it.

Table of Contents

What do you understand by Microblading?

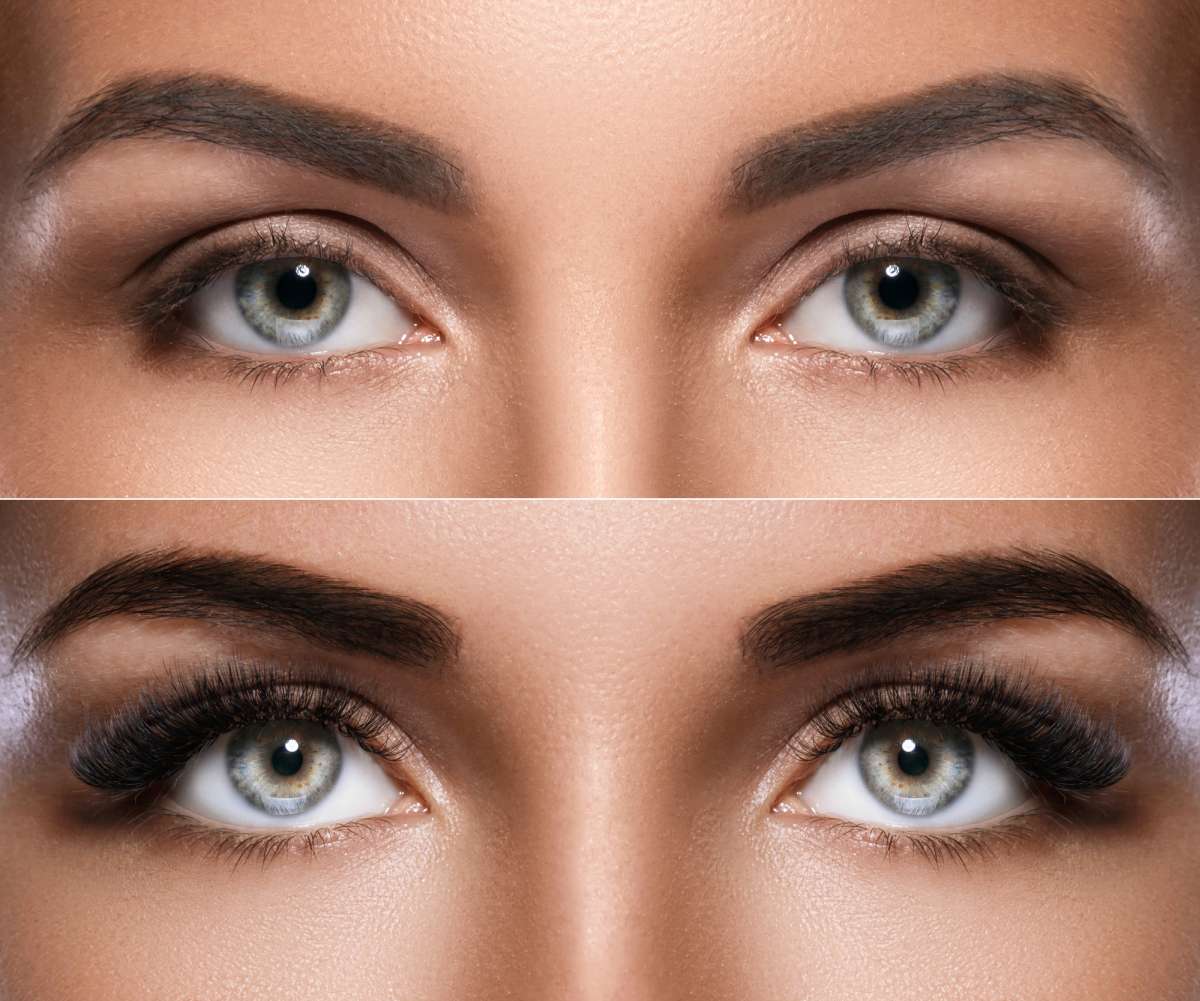

Microblading is a semi-permanent cosmetic procedure for our eyebrows. This process includes utilizing micro blades / micro needles to add pigment underneath your skin. Undergoing this procedure will let you have natural-looking, sharp, and well-defined eyebrows all the time.

The process of getting your eyebrows micro bladed generally requires three to four sittings. Each sitting is made seven to ten days after the previous sitting. This is because your eyebrows will need some time to heal. Additionally, the first session will be a lengthy one. It will cost you around three to four hours. The following two or three sittings will be comparatively short. They will generally take one to one and a half hours at max.

How long does microblading last after the completion of the entire process?

As mentioned previously, getting your eyebrows micro bladed will require three to four sittings in total. Also, you should maintain a gap of seven to ten days between each sitting. This gap will majorly depend on your skin type and its healing time. In this case, your microblading will last somewhere between eighteen and thirty-six months. This means if you correctly complete the microblading procedure, you can expect top-notch eyebrows for 1.5 to 3 years.

Factors affecting how long microblading will last

In addition to only completing the process, there are various other factors that contribute to how long does microblading last. Let us have a brief look at some of them.

1. The salon/clinic from where you got your eyebrows micro bladed.

The reputation of that particular salon or clinic from where you got microblading done matters a lot. For example, if you get your eyebrows micro bladed by a salon with highly experienced and qualified artists, your micro bladed eyebrows will last for a long time. However, the situation will be reversed if you go for a cheap salon with a bad reputation and client reviews.

2. Your skin type

The lasting period of your microblade eyebrows will majorly depend on the type of skin you possess. For example, if you have oily skin, it will be comparatively difficult for the artist to transfer pigment to the first layer of your eyebrow’s skin. This is because the layer of oil will prevent the stain from transferring and sitting on your skin.

3. Your age

Age is another major factor that affects how long does microblading last. This is because your skin type and its healing time both tend to change when you grow older. For example, the skin of a young teenager will comparatively heal faster than that of an older person. Additionally, you will also experience significant changes in your skin as you start growing older. Your skin might either become very dry or very oily. Hence, your age is something that you should consider before getting your eyebrows micro bladed.

4. The level of sun exposure

If you are someone who gets a lot of sun exposure, microblading won’t last long for you. This is because excessive sunlight will directly damage the micro bladed area of your skin. And clearly, eyebrows are something that cannot always be covered. The case becomes different with some other body parts.

5. Your skincare routine

Your skincare routine plays a significant role in deciding whether your micro bladed eyebrows will last for long. Or else all your money will go to waste. Hence, make sure you follow a minimalist and natural skincare routine to make your top-notch eyebrows last for a more extended period.

6. Whether or not you are following the aftercare instructions

There are certain aftercare instructions that your esthetician will provide you once you get your micro bladed. How long does microblading last completely depends on whether you follow all those prescribed aftercare instructions or not. Some of the general aftercare instructions provided by most of the estheticians include the following ones.

- Avoid excessive sun exposure.

- Do not sleep on your face. Also, avoid covering your face with a blanket until your micro bladed eyebrows completely heal.

- Keep a track of your diet. Try to consume a healthy and balanced diet.

- Do not frequently touch your eyebrows.

- Avoid applying any additional eyebrow product, such as eyebrow pencils or shadows, for a certain period. Avoid applying foundation and BB cream as well.

- Do not use an eyebrow brush or spoolie to brush your eyebrows.

7. The season in which you decided to get eyebrow microblading

The weather and the season play an important role in deciding how long does microblading last. With the winter season, there comes a lot of dryness. Additionally, it is believed that wounds and injuries take much longer to heal during the cold weather. Also, the pain tolerance tends to decrease. Hence, the microblading process might hurt more and take some additional time to heal. Also, it is possible that your eyebrows won’t last longer as you might not be able to take proper care of your micro bladed eyebrows. Similarly, there are certain plus points and drawbacks of getting your eye brows micro bladed in the summer season.

Difference between eyebrow microblading and eyebrow tattoo

Is microblading similar to getting a tattoo? People often interpret the process of microblading to be identical to the process of getting an eyebrow tattoo. However, both these processes are different from each other.

| Basis of | Eyebrow Microblading | Eyebrow Tattoo |

| Lasting period | It lasts for 1.5 to 3 years | It will last forever |

| Sitting sessions | Completed in 3 to 4 sessions | Finished in a single session |

| Type of pigmentation | Special Pigmentation | Strong Ink |

| Size of the needle/blade | Very small- thin | A comparatively thicker needle |

| Level of skin damage | Only the first layer | Includes many layers of the skin |

| Level of pain | Not much painful | Pains a lot |

| The type of look it gives | Give a natural look | Give an unnatural look |

How does microblading differ from eyebrow tattoo

- Lasting period- The lasting period of micro bladed eyebrows is only 1.5 to 3 years. You will either book a touch-up session or else, repeat the entire process to maintain your micro bladed eyebrows. On the other hand, an eyebrow tattoo will last for a long time until and unless you get it removed.

- Number of sitting sessions- When getting your eyebrow microblading, you will have to attend at least three to four sessions to achieve sharp, top-notch eyebrows. However, this isn’t the case when getting an eyebrow tattoo. Your tattoo artist will finish making your eyebrow tattoo in one sitting only.

- Type of pigmentation- While getting an eyebrow tattoo, the artist deposits a pigment into the deeper layers of your skin. Whereas, with eyebrow microblading, the pigment only reaches the first layer of your skin

- Size of the needle/blade- The size of the needle used for making a tattoo is much thicker than that of a microblading needle/blade. A tattoo artist generally uses a needle that is 1 mm thick. On the other hand, your eyebrow will be micro bladed using precise blades or needles that possess a diameter of 0.15 mm.

- Level of skin damage- The level of skin damage is comparatively higher when getting an eyebrow tattoo than microblading. The main reasons for this are the type of pigmentation used and the size of the needle.

- Level of pain- The previous point explanation holds true for this point as well. The level of pain is much less while getting your eyebrows micro bladed in comparison to an eyebrow tattoo. This is because microblading is done with thin needles and unique pigmentation, which only affects the first layer of your skin. However, the case is wholly reversed when getting an eyebrow tattoo.

- The type of look it gives- There is a significant difference in the kind of look microblading will provide you with when compared with that of an eyebrow tattoo. Micro bladed eyebrows are like a small cut on the paper. Your esthetician will not completely fill your eyebrows. Instead, they will do it in a way that makes your eyebrows appear very natural. Talking about getting an eyebrow tattoo, your tattoo artist will completely fill in the area of your eyebrows. This might not look good on some people.

Pre and Post-Care Instructions To Follow While Eyebrow Microblading

There are specific pre and post-care instructions that you should follow before and after the completion of the eyebrows microblading process. The way you consider and follow these instructions will majorly decide how long does microblading last. Let us briefly learn about all of them!

Instructions to follow before the eyebrow microblading process

- Avoid taking painkillers and drinking alcohol

It is advised that you should not consume alcohol or take any kind of painkillers/medicines including Crocin, Aspirin and other medication, 72 hours before getting your eyebrows micro bladed. Also avoid smoking cigarettes as well. This is because consuming either of these things will make your blood thinner.

- Avoid going in the sun

Sun exposure might lead to skin tanning. Hence, it would be best if you did not go out in the sun. This will help your esthetician access your natural skin tone and further decide which pigment colour will be the best for your eyebrows.

- Don’t use chemical scrubs or face peeling products

It is recommended that you should not use any face peeling products or chemical scrubs, for at least two weeks before getting your eyebrows micro bladed. This is because face peeling or scrubbing might lead to severe cuts or burns during the eyebrow microblading process.

Instructions to follow after the eyebrow microblading process

We previously listed some general aftercare instructions. These include not sleeping on your face, avoiding the sun, etc. However, there are more specific ones that your esthetician would want you to follow. Some of the main ones to consider are listed below.

- Moisturize your eyebrows

Two hours after the process of eyebrow microblading, moisturize your eyebrows. Firstly, grab a Q-tip and lightly clean your eyebrows. You can dip it in cooled boiling water. Gently wipe off your eyebrows. Further, apply a thin layer of a gentle moisturizer or healing balm. Keep using a moisturizer or healing balm twice for seven to ten days.

- Do not pick or peel the scabs on your eyebrows

After completion of the microblading process, you will notice some scabs over your eyebrow area. Please do not make the mistake of picking or peeling them. This might lead to an injury. Additionally, your eyebrows will take a lot of time to heal. Also, do not scratch your eyebrow area even if it itches. This might lead to infections and injuries as your eyebrow area is initially an open wound.

Important Note: The before and aftercare instructions of the eyebrow microblading process depend entirely upon your skin type. Your esthetician will first determine your skin type and further lay down the pre and post-care considerations. Hence, do not forget to discuss this point before getting your eyebrows micro bladed.

Winding up

Anyone who wishes to achieve sharp and well-defined eyebrows often wonders how long does microblading last. Well, now you know that certain factors and considerations will determine for how long will your micro bladed eyebrows remain the same. Hence, we recommend you have a detailed conversation with your esthetician on all the discussed topics. Understand your skin type, check which color will suit your face the best and then further get ready for the eyebrow microblading process.

Frequently Asked Questions (FAQs)

How long does microblading last?

In general, the process of microblading lasts for somewhere between 1.5 years to 3 years. Additionally, there are certain factors and considerations that further decide the lasting period of micro bladed eyebrows.

What are the factors affecting the lasting period of eyebrow microblading?

There are various factors that affect and determine how long will your micro bladed eyebrows last. Some of them include your skiing type and skincare routine, your diet, your age, the reputation and client reviews of the salon/clinic from which you are getting your eyebrows micro bladed.

Is microblading similar to getting an eyebrow tattoo?

No, the process of microblading is way different from the process of getting an eyebrow tattoo. Some of the significant differences are based on the basis of the level of pain, the type of look, and the time taken in the entire process.

What pre-care considerations should I keep in mind during eyebrow microblading?

You should follow some pre-microblading instructions, including avoiding sun exposure, not consuming alcohol, avoiding drugs/painkillers/general medications, and not peeling or scrubbing your face.

How is the tattoo needle different from that of the microblading one?

The size of the needle used to make the tattoo is approximately 1 mm. On the other hand, the size of the needle/blade used for microblading eyebrows is only 0.15 mm. Hence, this is the reason why getting an eyebrow tattoo pains more compared to eyebrow microblading.

Nupur Goyal is a passionate content writer with a total experience of 3 years in the same field. She has written content on diverse niches for many popular websites. She is currently working as a full-time content writer in a reputed digital marketing agency in Delhi. She is really fond of animals, especially dogs. She has a pitbull named Casper. The only thing she loves besides content writing is playing with dogs, may it be her pet or the strays. Oh, how could we miss including that junk food point. She is a vegetarian and enjoys eating junk food.