Who is the best guitarist of all time? Ever since the guitar was invented, this question has always been the topic of discussion. Also, giving a single name is hard. This is because different people have different taste in music due to which their favourite artist also differs.

In order to answer this question, we decided to come up with this blog on the five best guitarists who are believed to remain evergreen. We will discuss their journey as a guitarist and even list some of their famous songs. You may find your already favourite or, maybe, your new favourite here. Let us not waste anytime further and move on to it.

Table of Contents

Best Guitarist Of All Time- The Five Best Ones

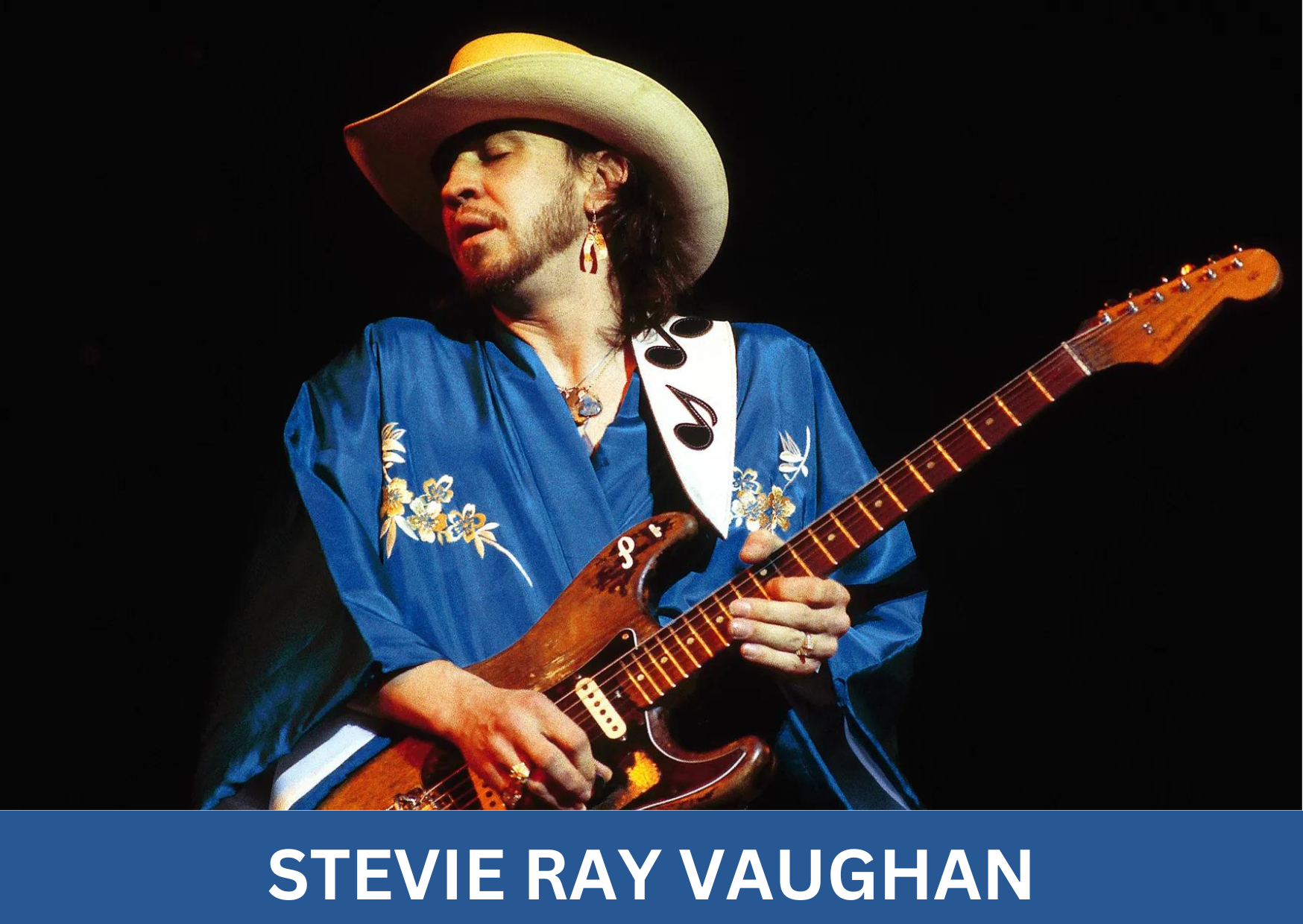

1. Stevie Ray Vaughan

The first one on our list of the best guitarist of all time is Stevie Ray Vugan from Dallas, Texas. His name is often abbreviated as SRV. His top strength was believed to be string raking. He had a fast-paced style of playing the guitar.SRV Was known to be one of the most influential guitarists in the 1980s. At that point in time, he was working with blues music and leading the revival of their rock.

Stevie Ray Vaughan was indeed one of the most unique guitarists. It is believed that he possessed a very unique style of playing the guitar, which no other guitarist could ever match. Rock, jazz, and blues were his main roots as a guitarist. Another amazing thing about SRV was that he played lead and rhythm on his guitar. However, this wasn’t the case with other guitarists. Instead, they used to keep a common progression throughout the song. It was the lead guitarist who would individually perform the rhythm as the song proceeded further.

Another interesting fact about SRV is that he was only seven years old when he started playing guitar. Also, he had no interest in academics and wanted to be a full-time guitarist. This was the reason he dropped out of high school.

Some of the evergreen hits by Stevie Ray Vaughan

SRV will always stay in peoples’ hearts. This is because his guitar tunes were very heart-touching. Here are some of his famous songs. We recommend you hear them for a better understanding of SRV’s work.

- Cold Shot

- Little Wing

- Change It

- Pride and Joy

- Life By The Drop

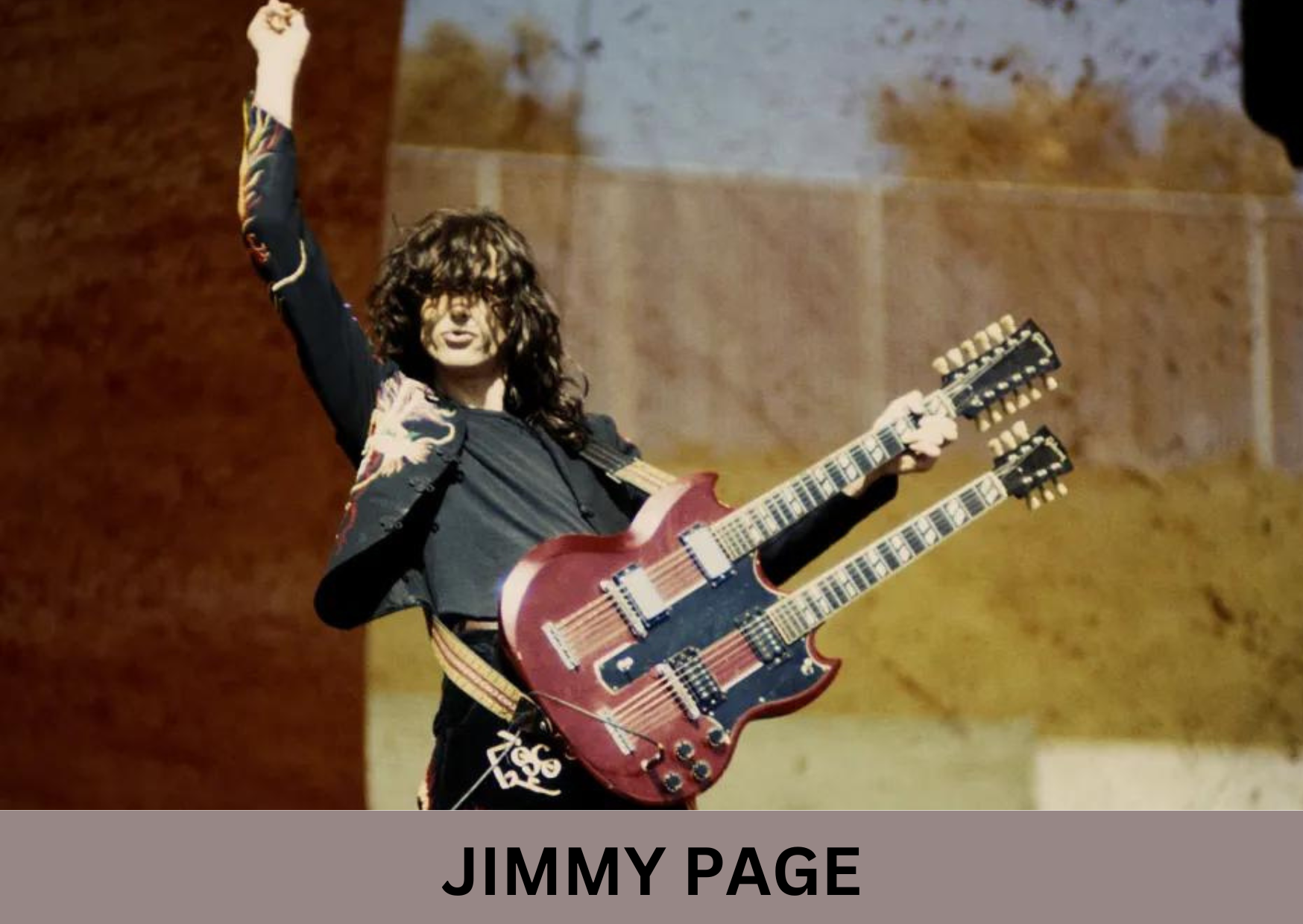

2. Jimmy Page

Jimmy Page is the second-best guitarist of all time. He was leading the guitarist team at Led Zeppelin. According to various sources, his top strengths included innovativeness and versatility. It is believed that he used to get very innovative while making effects with his guitar in a versatile manner. Additionally, he is known as a legend for performing straightforward licks. Additionally, while watching Jimmy Page perform. Fans also used to witness a deep relationship between a guitarist and a guitar.

Another thing that makes Jimmy Page a unique guitarist is his way of playing it. He was the first guitarist in history who played his instrument using a bow. This directly gave a haunting quality to Led Zeppelin’s music. Well, people believed this was actually his main goal, which Jimmy was able to achieve. Additionally, Jimmy was one of those guitarists who preferred using a theremin.

There were many other things that fascinated Jimmy during his teenage years. Some of them included collecting occults and mystical artifacts. However, the guitar was always his first love. In 1968, Jimmy Page was a member of the Yardbirds. This was even before he founded Led Zeppelin.

Some of the best songs by Jimmy Page

Jimmy Page will always be remembered for his complex guitar techniques. He was a master at sweep picking and alternate picking as well. He created various hooks and riffs, which made him the best guitarist of all time. Some of the masterpieces by Jimmy are mentioned below.

- Whole Lotta Love

- The Rain Song

- Communication Breakdown

- Satisfaction Guaranteed

- Midnight Moonlight

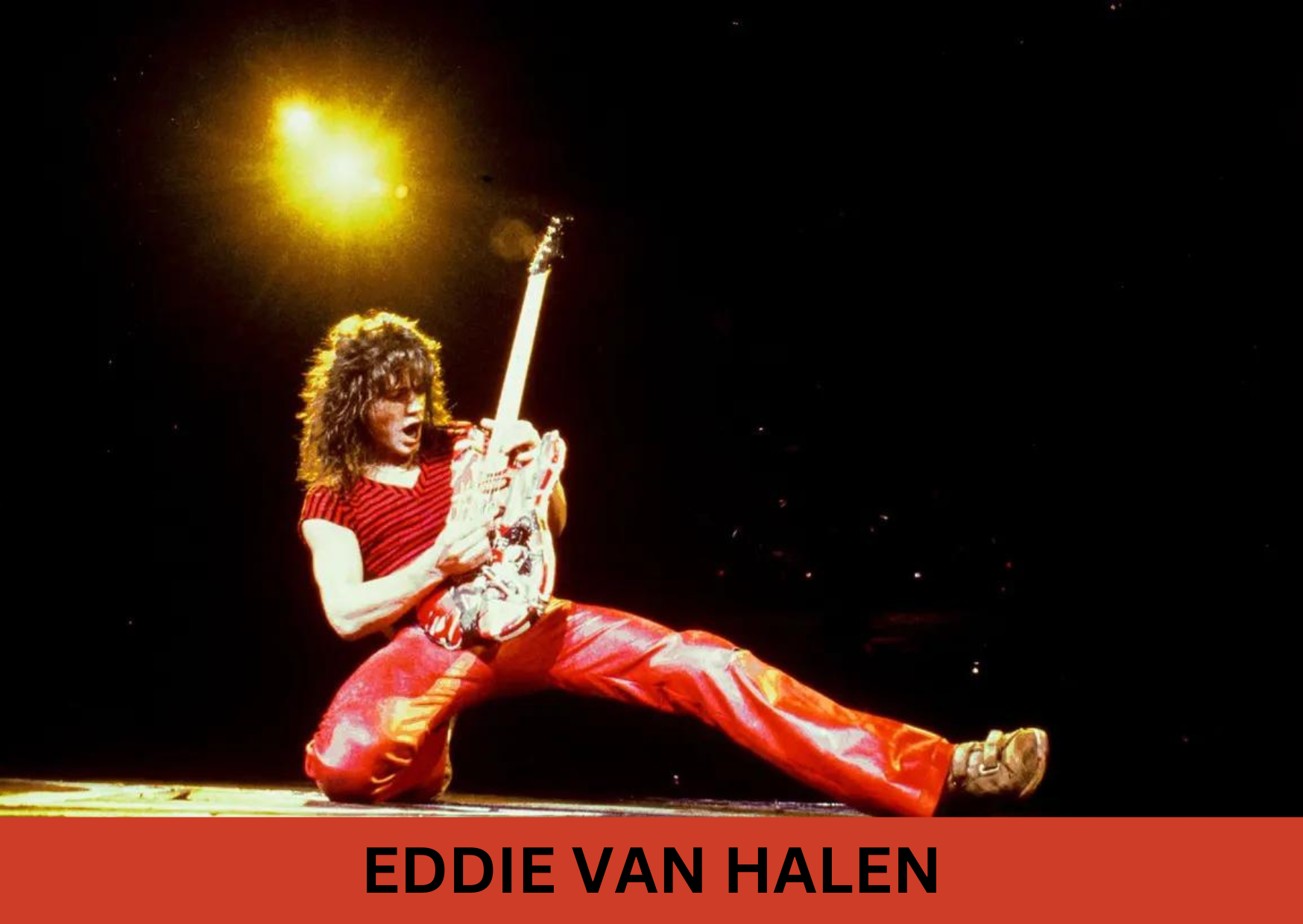

3. Eddie Van Halen

The third-best guitarist of all time on our list is Eddie Van Halen. No doubt, Eddie was and is one of the most influential guitarist. Along with David Lee Roth and his brother Alex, Eddie was one of the founders of the Van Halen Band. It didn’t take much time for his band to become a staple of the music scene in Los Angeles.

It was Eddie Van Halen who defined the rock music generation by creating magical sounds. According to various resources, Eddie was very good at tapping and whammy bars. These were believed to be his top strengths as a guitarist. Additionally, Eddie even invented new tricks and techniques that were never heard or seen before.

There are various interesting facts about Eddie Van Halen. He was a guitarist who made playing a guitar look simple. He used to practice multiple techniques to create different and unique musical tunes. However, people believe that Eddie was a gifted guitarist. This is because he never learned to play the guitar. Instead, he holds several patents for creating innovative devices. One of them includes an instrument that can be used for playing the guitar, like a piano.

Some of the best songs by Eddie Van Halen

Eddie Van Halen is a guitar god for his fans. Additionally, he still has a lot of influence on younger minds and potential guitarists. His way of utilizing that instrument can never be matched or compared. To experience his guitar tune, listen to some of the songs listed below.

- Runnin’ With The Devil

- Ain’t Talkin’ Bout Love

- Everybody Wants Some

- Somebody Give Me A Doctor

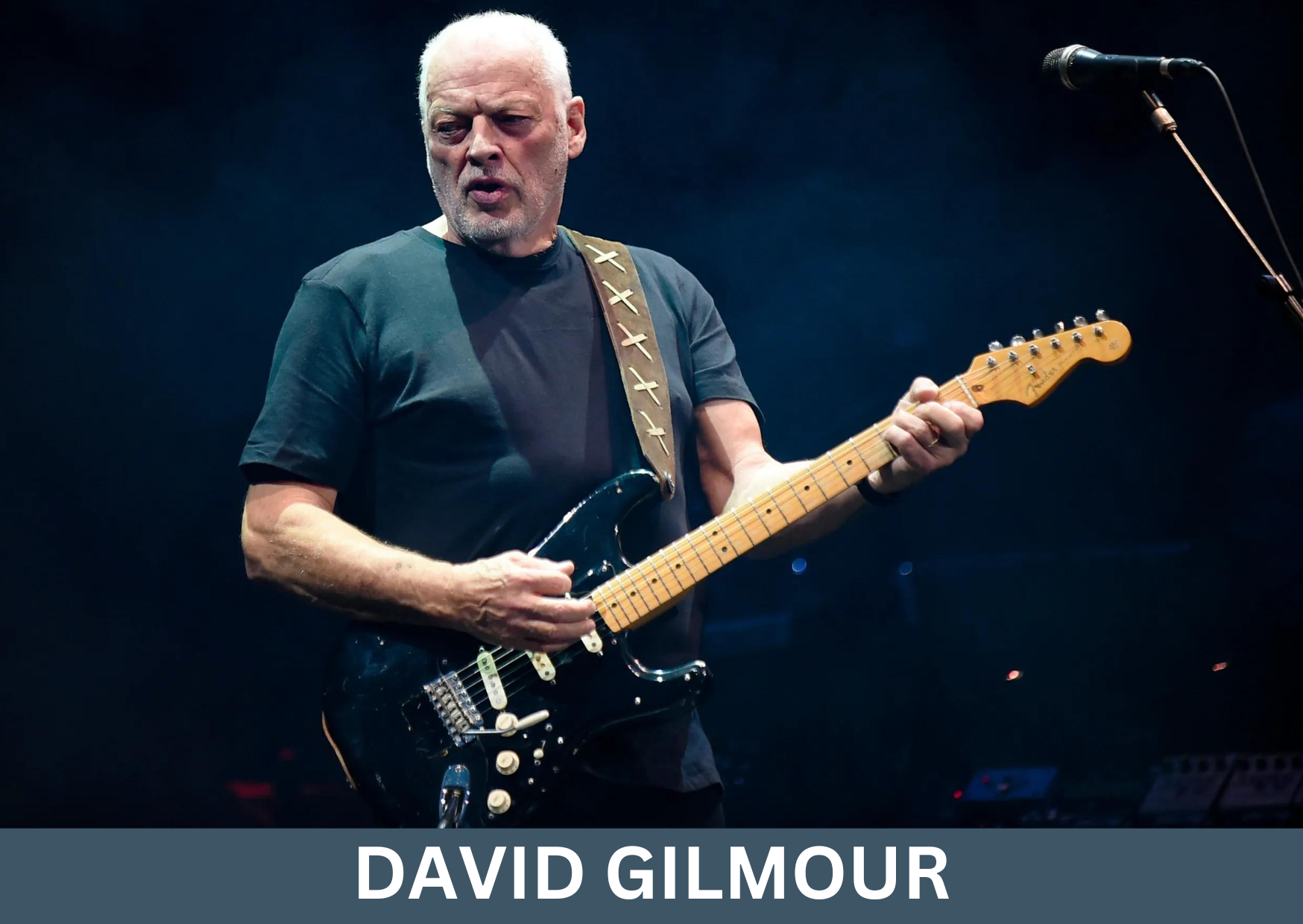

4. David Gilmour

Heard about the legendary band Pink Floyd? We are sure you must have heard about it somewhere or the other. Yes, David Gilmour was an important part of Pink Floyd. This legend is the fourth-best guitarist of all time on our list. He was the lead guitarist and singer in that respective band. While being a part of it, David was known for creating music that defined an entire generation.

Unlike other guitarists on the list, David was a fan of simplicity. He was very well known for composing simple ambient cords and huge riffs. Hence, mature simplicity is one of his core strengths as a guitarist. Also, he is exceptionally great at soloing lyrical guitar. Some fans find David’s solos a very sophisticated piece of musing. Whereas, there are people who think the complete opposite; they find his music a bit complicated. However, there is one common thing that they will both agree on. It is a fact that David’s music was clear like water.

Many interesting things happened in David Gilmour’s life. People are not aware of it, but David Gilmour can play many other instruments apart from a guitar. Also, it is hard to believe that Gilmour did not have a personal guitar until he turned 21. Also, there was a theft that took place in the 1970s when all of Pink Floyd’s instruments got stolen. The thieves even stole the Balck Strat, David Gilmour’s iconic guitar.

Some of the best songs by David Gilmour

Being one of the best guitarist of all time, David Gilmour will always hold a special place in our hearts. His simple way of playing mature themes will always keep him in the position of a great guitarist of all time. Here are some of his songs that you could listen to experience: his sophisticated, complicated, yet clear music tones.

- The Great Gig In The Sky

- Another Brick In The Wall

- Wish You Were Here

- Shine On You Crazy Diamond (available in different parts)

- Any Color You Like

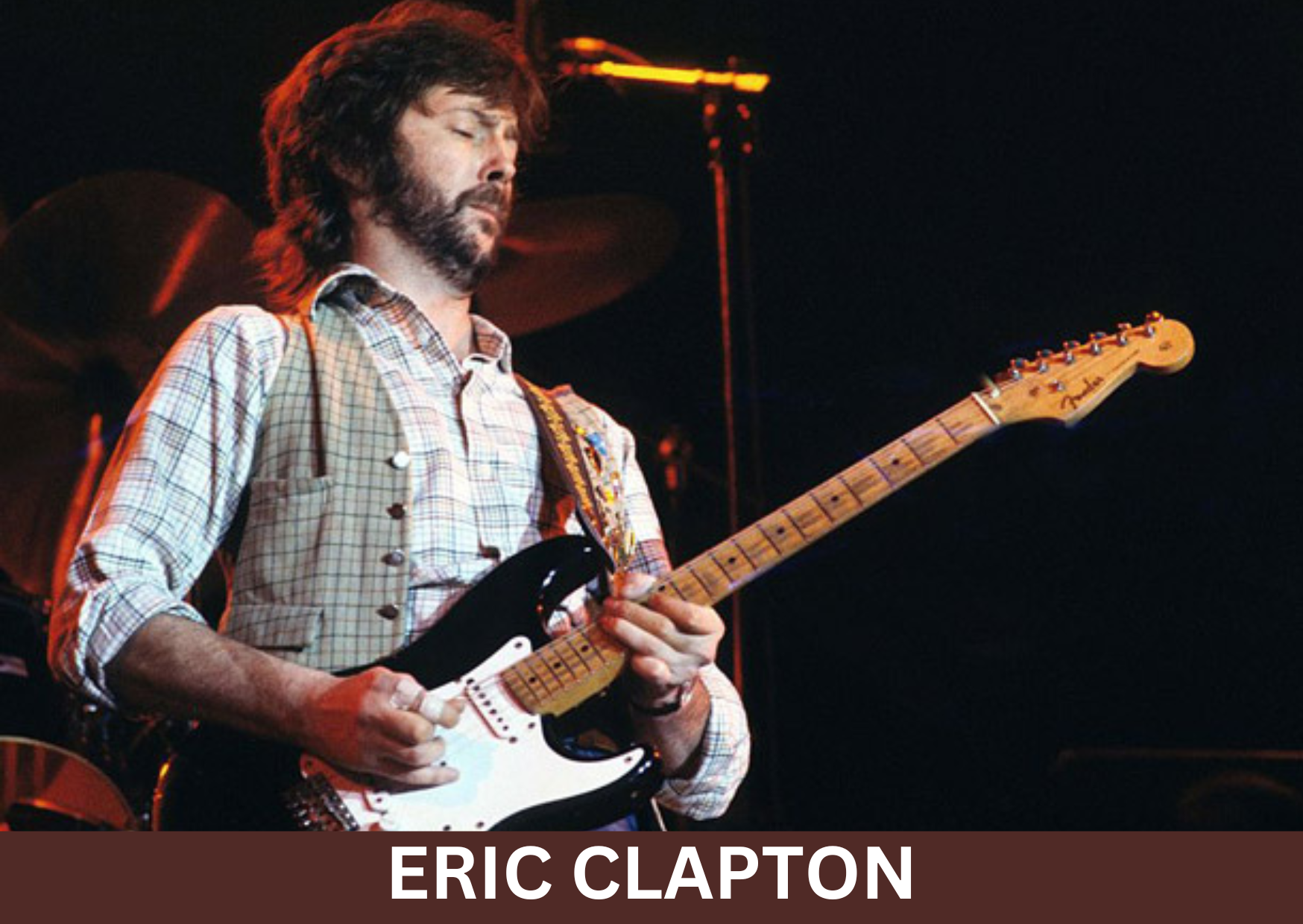

5. Eric Clapton

Eric Clapton is indeed an iconic and recognized name in the history of music. Clapton started his career as a guitarist in the 1960s. Before joining Yardbirds in 1963, Eric was associated with various local bands. It was basically his practice and experience-gaining phase. He was one of the few guitarists who came and instantly became a hit. It was somewhere between the 1960s and 1970s when Eric was labelled as the best guitarist of all time.

Every guitarist should possess the quality to address the crowd pleasantly. However, newbies and even experienced guitarists sometimes lack this quality. But Eric was a master at it. Along with exceptional instrumental skills, Eric Clapton was known for his indisputable mass appeal. He seemed like a one-man army during his performances. There was no point in the crowd challenging Eric in any way or the other.

Eric Clapton has lived an amazing life as a guitarist. After he was hit. people even started commonly using the phrase ‘Clapton is God.’ We think that this line is more than enough to inform the readers how popular Eric Clapton was.

Some of the best hits by Eric Clapton

Fans will always love Eric Clapton. He had an unmatchable way of touching hearts through his music. Instead, it wouldn’t be wrong to say that he was a master at it. Here are some of the mind-blowing hits by Eric Clapton. Do prefer listening to them.

- Why Does Love Got To Be So Sad?

- Sunshine of Your Love

- Have You Ever Loved A Woman?

- Crossroads

- Had To Cry Today

Winding up

Selecting and listing the five best guitarist of all time was indeed a very tough task. However, we deeply researched and came up with these five names. We want to apologize if we missed your favourite guitarist. Congratulations if you can find them in this list. You may have discovered at least one interesting fact about your favourite guitarist. And with this, our blog finally ends.

Frequently Asked Questions (FAQs)

1. Who is the best guitarist of all time?

1. It is very tough to take a particular name. This is because many influential guitarists are considered the greatest ones. Some of them include David Gilmour, Eddie Van Halen, and Stevie Ray Vaughan.

2. Which band did Jimmy Page work with?

2. Jimmy Page was working with the band Led Zeppelin. As per the records, he was the lead guitarist over there.

3. What did Eddie Van Halen’s core strengths include?

3. Eddie Van Halen was very good at tapping and whammy bars. These two were his core strengths as a guitarist.

4. How popular was Eric Clapton as a guitarist?

4. Eric Clapton is an iconic guitarist in the history of music who instantly became popular. He was so famous amongst people that using the phrase ‘Clapton is God’ was getting way too common.

Nupur Goyal is a passionate content writer with a total experience of 3 years in the same field. She has written content on diverse niches for many popular websites. She is currently working as a full-time content writer in a reputed digital marketing agency in Delhi. She is really fond of animals, especially dogs. She has a pitbull named Casper. The only thing she loves besides content writing is playing with dogs, may it be her pet or the strays. Oh, how could we miss including that junk food point. She is a vegetarian and enjoys eating junk food.